November 25th 2019

Artorius set to break £1bn AUM as organic growth continues 25th November 2019

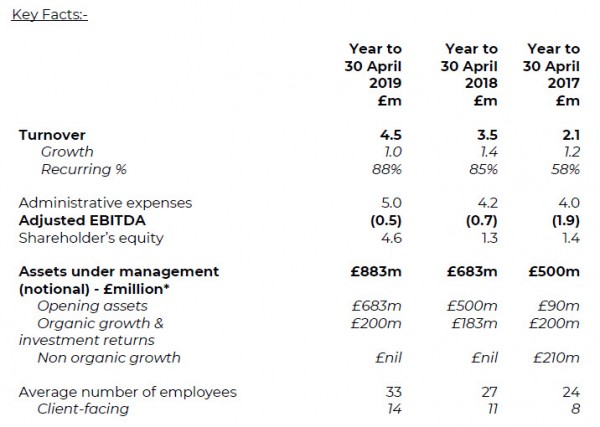

Artorius Wealth reported an adjusted EBITDA loss £(0.5)m for the financial year 30th April 2019, versus £(0.7)m in the prior year. Revenue reported of £4.5m, compared to £3.5m in the prior year period.

The directors are pleased with continual progression on turnover and development of the client offering, whilst maintaining control over administrative expenses. Adjusted EBITDA has improved significantly over the 3-year period, whilst the business continues to invest in client experience, systems and scale. The group during FY 2019 was operational cashflow break-even, and chose to invest further in strategic hires, client experience and operating platforms to help build a high-quality, long-term recurring revenue-based business.

Net revenues were £4.5m, a 29% or £1m increase reflecting the continued growth in assets under management reflecting strong demand for our personalised services to our clients. Recurring revenue now accounts for 88% of total revenue. The directors remain pleased with the quality of the income, and the quality of the client relationships with individuals and families seeking long-term partners in providing wealth planning, family governance & oversight, and investment advice.

AUM* increased by £200m to £883m as at 30th April mainly from client inflows within its Discretionary, Advisory & Family Office offering, as well as superior investment return relative to the peer group as measured by Asset Risk Consultants. The group are pleased to see organic growth of ~£200m per annum for a third successive year.

Administrative costs were £5.0m, an increase of £0.9m year-on-year reflecting the relocation of our London office, investment in our family office proposition and IT platforms, plus a number of strategic hires to support the business to meet the group 5-year plan. Reported FTE had increased by 10 to 37 employees by the financial year end, with a further 8 staff have being hired subsequently. During the year the group raised £4.2m of equity for investment into the business to accelerate growth in line with our 5-year organic plan. The capital has been targeted for selective hiring of individuals and teams, as well as further development of our client experience, systems and increased regulatory capital. The group has also converted £2.3m of loan notes into equity in the next financial year. This will further support investment within the 5-year business plan as well as reducing the interest burden of the group.

AUM* stands at £950m as at 30th September 2019 with offices located in Manchester, London & Zurich.

Ian Bennett, Group Finance Director - "Artorius continues to build on its strategy of developing a high-quality, long term wealth management business. We are continuing to see strong organic AUM growth by attracting clients and talented staff that like our personalised service that addresses their individual unique circumstances. Whilst the industry continues to commoditise products and reduce service levels, we are proud to show that there is another way"

Mike Toole, COO - "We are delighted with the momentum that we have seen over the last 3 years. Artorius’s ability to navigate through complex wealth planning issues, source the best in breed of investment products and services, and offer an exceptional client experience is proving to be an attractive proposition to recruiting both clients and staff."

*Assets under management (notional) represent all client assets that are managed, advised or influenced through discretionary, advisory and family office mandates at the period end in GBP equivalent, and weighted at a revenue margin of 0.5% from the underlying recurring mandate fee charging structure.