Down Sizing

Down Sizing

Valuations suggest that some US large cap companies are priced for very strong growth, especially for those technology giants associated with Artificial Intelligence. Other areas of the US equity market look more attractively valued. Similarities abound with the late 1990s equity bubble, after which the internet equity bubble faded and large-caps underperformed other areas, even though the economy was weak. It is noticeable that over the past few months US equities have continued to climb, but the largest Technology companies are no longer leading the market higher as other sectors have seen investor inflows.

US interest rates have been cut for the first time since 2020, as slower US economic growth is being felt in the US labour market resulting in a slight increase in unemployment. Investors seem to be discounting more interest rate cuts than the Federal Reserve have themselves forecast, but the easing path appears to set.

Oil prices have eased back to below $70 per barrel, down from $85 in the spring. The fall in the price of oil is on the back of lower demand from China as its economy continues to remain weak. Lower oil prices should be helpful to consumer spending power and reducing inflationary pressure across the world. This in turn should enable Central Banks to cut interest rates in coming months.

UK economic prospects seem to be improving on the back of a stronger consumer (wages are growing in real terms) and the housing market is benefitting from lower interest rates. The UK economy has exceeded expectations over the past six months, and the positive momentum in the UK housing market may aid economic growth through 2025.

Politics matters. The forthcoming US election on 5th November and UK Budget on 30th October may weigh on investor appetite in coming weeks. We will act and advise our clients accordingly.

Just a medium please

Investors into US equities have benefitted over recent years from the dominance of the super-sized mega-caps. The so-called Magnificent Seven (Apple, Meta (Facebook), Amazon, Nvidia, Tesla, Microsoft and Alphabet (Google)) have dominated US equity markets. To some degree their strong performance reflects the delivery of profits which have grown robustly in recent years, compared to the lacklustre profits growth from the rest of the US equity market. Some of these companies are linked (to some degree) to Artificial Intelligence (AI). AI may (may) change the nature of business, in a similar way to how the internet changed society over the past 30 years.

The rhyming of both equity market and economic conditions with the turn of the century has prompted us to change US equities exposure within clients’ portfolios. At the end of 1990 so-called ‘Quality’ stocks (‘Quality’ is a concept that filters investments into companies with high return on equity, stable earnings growth and low financial leverage) performed exceedingly well as companies with high rates of growth captured the hearts, minds and wallets of investors. Other companies were left behind. The valuation of the large companies outstripped those of the rest of the market. So it is in 2024.

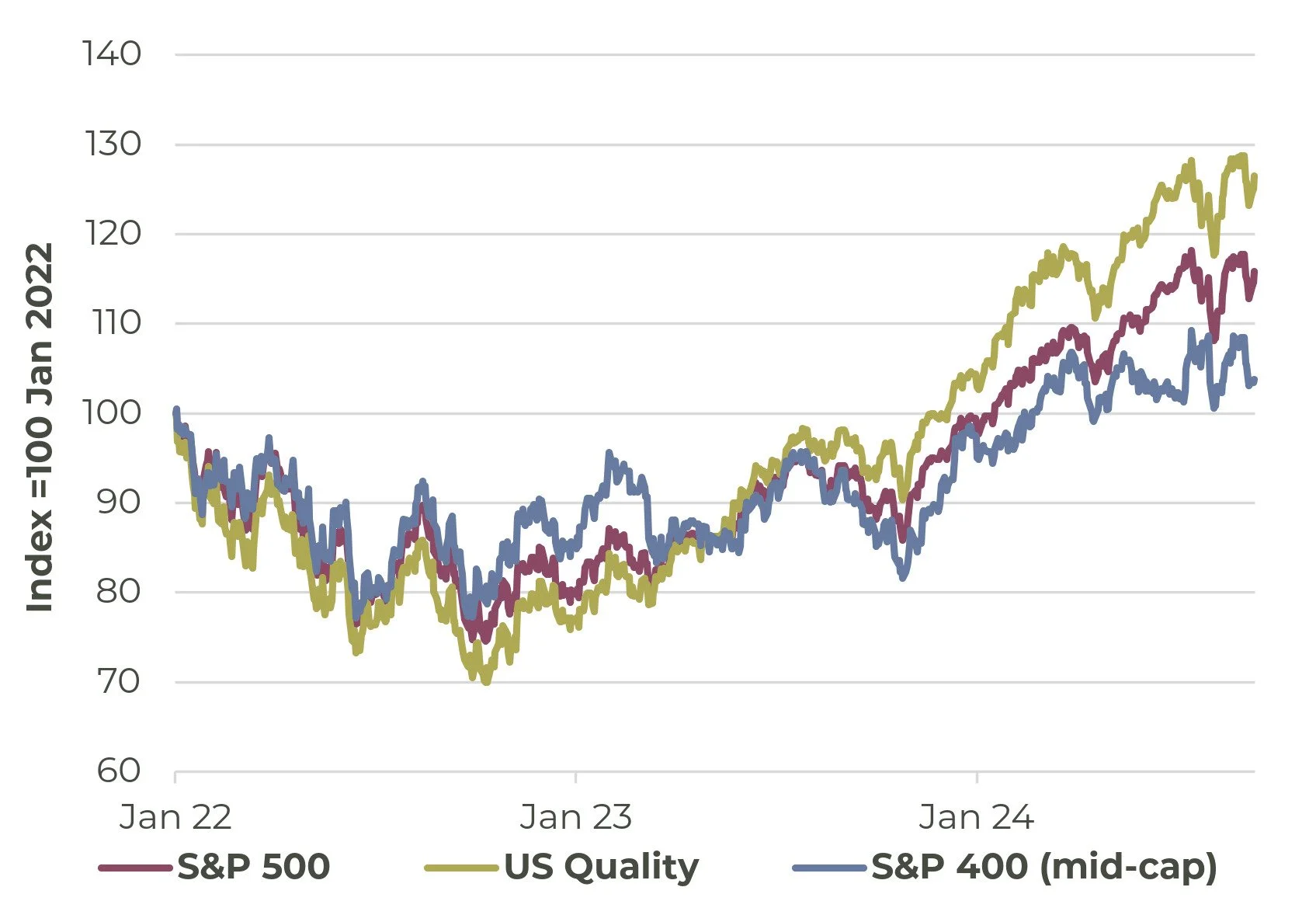

US Quality Equity ‘style’ index has outperformed the wider US equity market (as measured by the S&P 500), and the medium-sized companies as measured by the S&P 400.

Source: Bloomberg, Artorius

Recent corporate updates may suggest that the pace of growth from the likes of Nvidia is slowing. Whilst growth remains impressive, the pace of growth and the extent to which Nvidia is beating expectations has eased. The fickle investor community, having been cheerleaders for anything connected to AI, is now questioning the profitability of corporate activity in AI, and is wanting to see the return on investment.

““History doesn’t repeat itself but it often rhymes””

By looking at Price to Earnings ratios, one can see that compared to the medium sized companies (S&P 400), the larger companies (S&P 500) trade on much higher valuations. As doubts over the profitability of AI start to emerge, there is a risk that Quality (which is heavily skewed to Technology) may underperform.

Price to Earnings ratio: S&P 500 (US large companies index) trades at a much higher valuation than the S&P 400 (medium sized companies)

Source: Bloomberg, Artorius

The risk is that the elevated valuation represents hope (greed?) around AI and if that hope is misplaced or replaced by fear then it is possible that the larger technology names that have done so well over the past few years could materially underperform. This would rhyme with the pattern post 2000, when internet related stocks that had performed robustly in the late 1990s fell sharply through 2000-2003. Even those companies such as Cisco and Amazon that delivered strong revenues in subsequent years saw falls of around 90% from their 2000 peaks. There is no doubt that the internet changed much of society, and it could be the case that AI will enable change in a similar fashion in future years. But has too much potential been baked into the AI related companies?

Post 2000 performance pattern: S&P 400 held its own even though the economy was in a recession and the US 500 and US Quality index fell by over 20% after the market peak in March 2000

Source: Bloomberg, Artorius

Looking at the post-2000 period, we were surprised to see how well the S&P 400 performed, even though the S&P 500 (US large companies) fell by 28% between March 2000 and September 2001 (before the events of 11th September). This was at the start of a recession which was then compounded by the after-effects of the terrorist attack.

Investors may wish to think about trying to capture a broader sweep of returns in coming years and diversifying away from the large cap technology companies that have dominated US equity markets for the past decade.

Cuts start in the US

The Federal Reserve has cut interest rates. On Wednesday 18th September interest rates were reduced by 0.5%. This was the first cut in rates since 2020. The Central Bank has been trying to engineer a so called ‘soft-landing’, in which inflation would ease back towards 2% without a significant rise in unemployment. So far, so successful. Whilst inflation remains above 2% (currently at 2.5%), there are signs of a slowdown in hiring in the jobs market.

This slowdown in job creation is showing up in weakness in household income and consumer spending patterns, especially amongst lower income households. The bond markets are discounting further interest cuts in 2024 and 2025.

The Federal Reserve provided an update on its own interest rate forecast. In its June forecast, only eight of the eighteen policymakers thought that the Federal Reserve would cut by 0.5% or more by the start of 2025. After the meeting this week (18th September) the Federal Reserve policy makers expect rates to fall by another 0.5% by the end of the year and by 1% through 2025. This is less than the markets are discounting but the direction of policy easing seems set.

The Federal Reserve has joined other Central Banks in cutting interest rates

Source: Bloomberg, Artorius

Oil price has slipped lower over the past few months which ease inflationary pressures further

Source: Bloomberg, Artorius

Oil spill maybe good news

Oil prices have fallen to below $65 per barrel. This time last year oil was hovering around $95 and was between $80 and $85 for much of the past six months. Lower oil prices should be good news for lower inflation and also aid the spending power of the consumer, both in the US, and closer to home in the UK. In the UK, the strength in Sterling means that the oil price has fallen by about 30% (in GBP terms) since the 2023 peak, and has declined 20% in the past few months. The consumer could be in for an unexpected boost to spending power as oil price declines ease through to lower petrol prices.

In the spirit of Thomas Carlyle’s 1849 label that economics is the dismal science, good news in lower oil prices is not without its problems. Weakness in Chinese economic growth has resulted in a reduction in oil demand. Alongside continued elevated supply from the likes of the US and other non-OPEC countries, old fashioned economics (no AI required here) means that lower demand and higher supply is pushing prices lower.

UK housing building momentum?

UK economic data suggests that the economy has stalled in recent months. Whether this is due to the weather (poor summer weather impacted consumer spending according to company updates) or a hiatus due to the July general election, time will tell. One area of recovery appears to be the UK housing market, and the housing market is often a key determinant of the broader economy.

The Royal Institution of Chartered Surveyors (RICS) issue a monthly survey which takes the temperature of the housing market. The September 2024 RICS UK Residential Survey results continue to depict a turnup in housing market activity. Housing market activity appears to be picking up on the back of the interest rate cut from the Bank of England in August 2024 and the expectation of further cuts, which has seen 5-year mortgage rates ease back to around 4%.

The New Buyers Enquiries indicator points to a recovery in households searching for homes to buy. Historically, when the number of New Buyer Enquiries increases, house prices subsequently climb and housing market transactions rise. This in turn stimulates consumer spending across a wider range of sectors.

One hopes that the Labour Budget for the end of October doesn’t dampen nascent recovery signs. One might suggest that the economy may respond better to some upbeat Reagan-esque rhetoric rather than the Eeyore mood music currently being put out by the Government.

The Royal Institution of Chartered Surveyors (RICS) report suggest that the UK housing market is rebounding leading to a recovery in house prices as New Buyer Enquires has risen in recent months

Source: Bloomberg, Artorius

*Any feedback provided can be anonymous

Conclusion

Valuations remain elevated for US large companies, especially for the technology giants. Other areas of the US equity market look more attractively valued. Similarities abound with the late 1990s equity bubble, after which the internet equity bubble faded and large-caps underperformed other areas, even though the economy was weak. It is noticeable that over the past few months US equities have continued to climb, but the largest Technology companies are no longer leading the market higher as other sectors have seen investor inflows.

US interest rates have been cut. Investors appear to be discounting more cuts through the rest of 2024 and into 2025. Investors seem to be discounting more interest rate cuts than the Federal Reserve have themselves forecast, but the easing path appears to set.

Oil prices have eased back to below $70 per barrel, down from $85 in the spring. The fall in the price of oil is on the back of lower demand from China as its economy continues to remain weak. Lower oil prices should be helpful to consumer spending power and reducing inflationary pressure across the world. This in turn should enable Central Banks to cut interest rates in coming months.

UK economic prospects seem to be improving on the back of a stronger consumer (wages are growing in real terms) and the housing market is benefitting from lower interest rates. The UK economy has exceeded expectations over the past six months, and the positive momentum in the UK housing market may aid economic growth through 2025.

Politics matters. The forthcoming US election on 5th November and UK Budget on 30th October may weigh on investor appetite in coming weeks. We will act and advise accordingly.

Important Information

Artorius provides this document in good faith and for information purposes only. All expressions of opinion reflect the judgment of Artorius at 20th September 2024 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results.

Nothing in this document is intended to be, or should be construed as, regulated advice. Reliance should not be placed on the information contained within this document when taking individual investment or strategic decisions.

Any advisory services we provide will be subject to a formal Engagement Letter signed by both parties. Any Investment Management services we provide will be subject to a formal Investment Management Agreement, which will include an agreed mandate.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20240920001