Election Watch and looking back on Q2

Election Watch

and looking back

on Q2

As expected, Labour have won a landslide victory in the UK general election and will have a huge majority of a similar scale to their victory in 1997. The Conservative party had the worst result in their history bringing to an end 14 years of rule and ushering in a potentially long spell in opposition. The Liberal Democrats had their best result (in terms of seats) in 100 years and Reform took over 14% of the vote but only 4 seats, such are the vagaries of the first past the post system. In Scotland, the SNP lost the majority of their seats as Labour swept the lowlands and showed that in 2024 incumbents are struggling in elections. In Wales, the Conservatives lost all of their seats and in Northern Ireland after losses for the DUP, Sinn Fein won the most seats, although they won’t sit in the UK Parliament.

So what does this all mean? In the short term, economically, very little. The Labour manifesto was deliberately light, they are broadly committed to Conservative spending plans, which implies some fiscal consolidation, and have promised not to raise any of the largest tax generators. While one hopes that planning reform can improve economic growth longer-term, in the short-term the new government will have little economic impact. Although after numerous changes of prime minister over recent years, simply providing stability will be of reassurance to markets after the previous turmoil.

While the UK election has been a little dull, elections elsewhere are a bit spicier. Sunday is the second round of French parliamentary elections. The first round saw parties on the left and right making gains against President Macron’s party with Marine Le Pen’s Rassemblement National (RN) leading the way and raising concern of a right-wing populist government. In the French system any candidate with 12.5% of the vote moves in to the second round but a number of candidates from the left and centre have been dropping out to avoid splitting the anti-RN vote and thereby hoping to stop them winning an absolute majority. The most likely scenario is that nobody wins an absolute majority but the political uncertainty will linger until a new government is formed.

Also, while the US election is not until November 5th, the first election debate caught the imagination in a way that UK debates have not. A stumbling performance from President Biden has caused waves, with calls for him to step down and let someone younger run in his place. At this stage it is unclear if he will step down and if so who would replace him (or indeed how) but what is clear is that this has significantly benefitted Donald Trump and makes his victory more likely. We will address the potential implications of that, particularly if accompanied by a Republican congress, in future notes.

Second Quarter Review

The first half of 2024 ended on a high note for equities with strong performance in May and June after a wobble in April. Global equities rose by 2.8% in Q2 for a Sterling investor and have risen 12.6% in the first half of the year (H1). The US continues to lead the way driven by continued strong performance from the so-called “Magnificent 7” mega-cap technology stocks (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla), although much of this is due to one stock, Nvidia (up 159% in H1), which is seen as the key beneficiary of the growth of Artificial Intelligence (AI). Indeed AI has very much been the theme of 2024 with the leading performers generally being AI linked. Last quarter we highlighted that Apple had lagged, in part because it wasn’t seen as a key AI beneficiary but with the announcement of several new AI features and a partnership with ChatGPT-maker OpenAI, the stock saw significantly better performance.

In Q1 we saw signs of a broadening rally across the US market but this largely disappeared in Q2 with gains in the big-tech names not being reflected in the wider market. If you strip out the Magnificent 7, the rest of the US market actually delivered negative returns over the quarter.

Europe struggled through the quarter as despite the tailwinds of improving economic performance and interest rate cuts from the European Central Bank (plus Switzerland and Sweden), politics, specifically French politics, caused a sell-off. While the European election results showed increasingly support for populist parties, it was the decision of President Macron to call French parliamentary elections which has caused turmoil. Concern over a potential victory for Marine Le Pen’s RN party has caused a sell-off in French equities and bonds.

The worst market though for a Sterling investor was actually Japan and this is all about the weakness of the Yen (down over 6% in Q2 v GBP). The Japanese equity market (Topix) ended June close to an all-time high but when those returns are translated from Yen back to Sterling they turn negative.

The major directional change in equities has been a stark improvement in the performance of Emerging Markets, most notably China, which after a terrible start to the year (following 3 equally terrible years) has started to perform again. Economic performance is improving and valuations remain fairly cheap, which has led to improved investor sentiment and better stock-market performance.

While the Magnificent 7 once again dominated equity returns in Q2, the rest of the US did not participate. Emerging Markets having been the laggard was actually the strongest region, with China outperforming.

Looking at the year-to-date, equity performance has been fairly consistent globally except for the standout performance of the Magnificent 7 (led by the perceived AI beneficiaries, notably Nvidia)

Source: Artorius, Bloomberg

Indices used are: Global – MSCI All-Country World, UK – MSCI UK, US – S&P 500, Magnificent 7 – Bloomberg Magnificent 7, S&P ex Magnificent 7, Europe ex UK – MSCI Europe ex UK, Japan – MSCI Japan, Emerging Markets – MSCI Emerging Markets, China – MSCI China

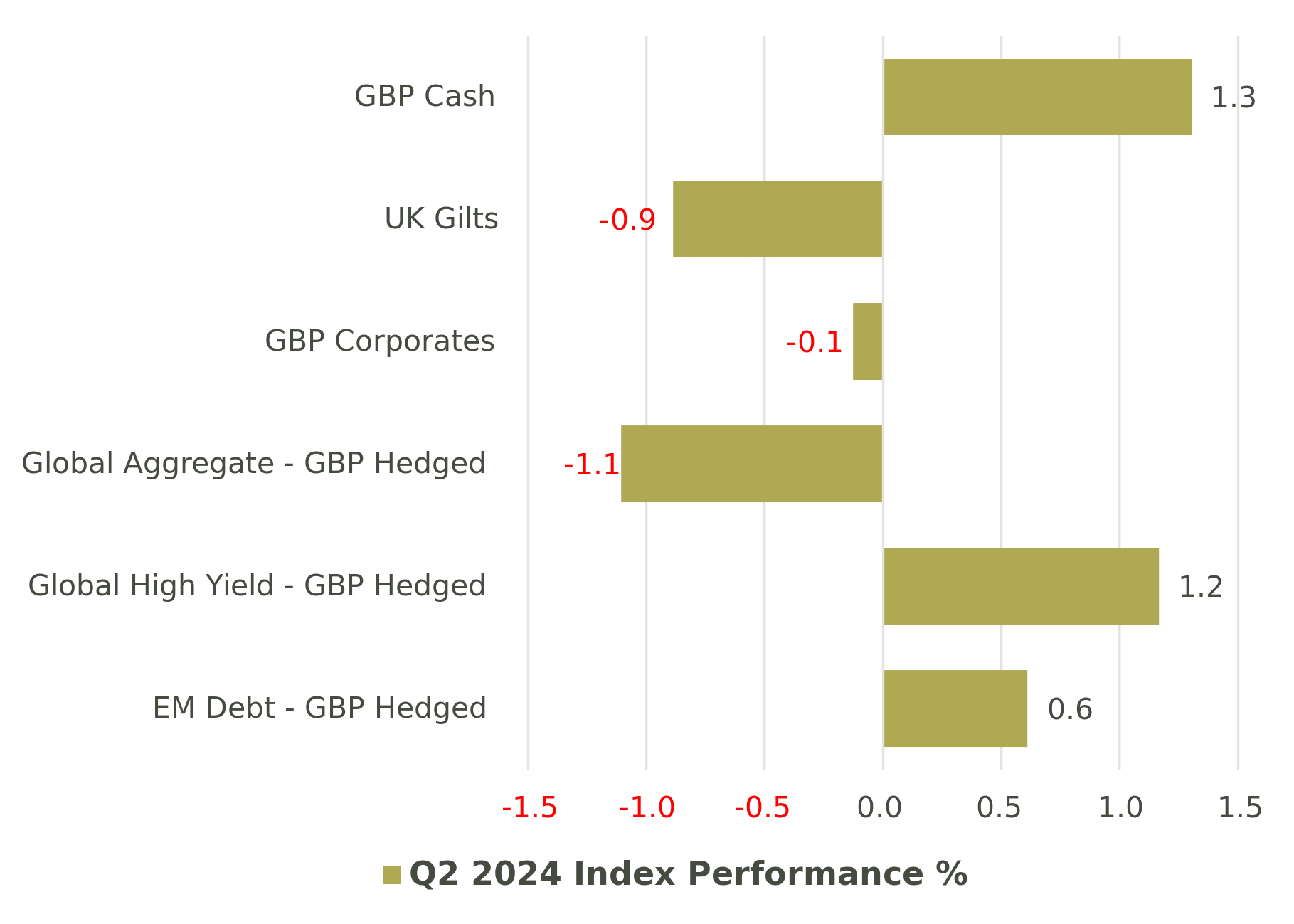

In Fixed Income, the second quarter continued the trend of the first with markets waiting for central banks to cut interest rates as inflation pressure subsides. While in Europe, the ECB (European Central Bank), Switzerland and Sweden all cut, the US and the UK are still holding off. This delay in easing has seen bond prices drift lower and bond yields correspondingly rise. In the absence of interest rate cuts, cash (and short-term bonds) has been the place to be as investors can earn attractive interest rates. As and when interest rates fall, we would expect longer-dated bonds to outperform cash but while we wait, cash has been king. The other segments that have performed well have been riskier bonds, High Yield and Emerging Markets debt. Spreads on riskier bonds have tightened significantly and are trading at unattractive levels, however in the absence of a recession or a sizeable default cycle there has been no catalyst to spark a sell-off. Headline yields in fixed income remain attractive and we still believe that interest rate cuts are coming this year but for now returns are muted.

In currencies, returns have mainly been driven by the change in interest rate differentials between the main regions. With the ECB cutting rates in Europe (plus French politics) the Euro has weakened versus other major currencies, whereas the US Dollar continues to strengthen as interest rates remain high and no cuts seem imminent. The Yen is the most stark example with investors taking advantage of very low interest rates in Japan to borrow and invest elsewhere (“the carry-trade”), which is forcing the Yen to record lows.

Bonds lagged in Q2 as interest rate cuts weren’t forthcoming (except in Europe) and bond yields continued to rise. Riskier bonds (credit, Emerging Markets) outperformed Sovereign bonds with credit spreads remaining very tight. Cash was king, at least in Fixed Income.

Year-to-date show the same picture with bonds lagging equities but returns should improve as and when interest rates start to fall. The outperformance of riskier bonds will likely be limited by their valuation.

Source: Artorius, Bloomberg

Indices used are: GBP Cash – Barclays Benchmark Overnight GBP Cash Index, UK Gilts – Bloomberg UK Government All Bonds, GBP Corporates – IBOXX Sterling Non-Gilts, Global Bonds – Bloomberg Global Aggregate Hedged GBP, Global High Yield – Bloomberg Global High Yield Hedged GBP, Emerging Markets Debt – Bloomberg EM Hard Currency Aggregate Hedged GBP

Gareth Thomas

Head of Investment Management

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 5th July 2024 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20240507001