Making America Great Again?

Making America Great Again?

Over $3trillion of value was wiped off equity markets this week. The cause? President Trump in the Rose Garden with a tariff bludgeon. Trump 2.0 has talked a lot about tariffs, some of the talk has actually turned into policy (against Canada, Mexico and China), but it has all been building to so-called “Liberation” day on April 2nd and the announcement of “reciprocal” tariffs. The scale of the announcement was much larger than expected and not really reciprocal as they didn’t reflect tariffs of trade barriers in place against the US. Instead, the tariffs levied were simply in relation to the size of a country’s trade deficit to the US, whatever the reason for it. However, according to Trump and his team trade deficits are bad whatever their cause and should be taxed accordingly.

There is a baseline tariff of 10% on goods from all countries (although there are some significant exemptions, e.g. semi-conductors and various key minerals not found in the US), and an “individualised reciprocal higher tariff” on the “worst offenders” ranging from 10% to 50% depending on the trade gap between the countries. At the top-end, Cambodia was hit with 49% (nearly a fifth of the population live below the poverty line – unsurprisingly they don’t have a lot of money to import goods from the US!), Vietnam was 46% (over a third of US trainers are produced there so Nike/Adidas are about to get a lot more expensive), China was hit with an additional 34% (taking them up to 54% in total), the EU 20% but there were no new tariffs on Canada and Mexico. The UK is on the lowest level of 10% but will hope to negotiate a better deal because even 10% will cause economic pain. The basic tariff is due to take effect from 5th April while the higher reciprocal tariffs will apply from 9th April.

We would expect intense negotiation over the coming days and hope (like some of those previously announced) that deals may be made to reduce and/or delay these tariffs because at the current levels this will have significant negative economic impact globally, particularly if other countries respond in-kind as seems likely. Indeed at the time of writing China has just matched the 34% tariff on US goods.

If enacted these announcements would take US tariffs against trading partners to their highest level since the 1940s (estimates range between 20-30% for the effective tariff rate) and would be the largest increase since the Smoot-Hawley Tariff Act of 1930, which, while not causing, was certainly a major contributor to the severity of the Great Depression.

Recessionary risks have increased significantly. Already economic survey data is weakening, new orders are falling, inventories are rising, and businesses are reporting higher prices – an unhealthy combination hinting towards stagflation risks. Therefore, a US recession this year is now a real possibility and so equity market volatility is likely to remain elevated. The flip side of this is a weakening economy that may well lead to central banks cutting interest rates more aggressively. Markets now expect four interest rate cuts from the US Federal Reserve by year-end.

First Quarter Review

After such a dramatic week it is easy to ignore what has happened previously but at the end of the quarter we like to reflect on the preceding months.

Market performance has been driven by the change in US President and while his stated aim is to “Make America Great Again”, when we look at markets the opposite is true. After an extended period of US exceptionalism, US equities have underperformed the rest of the world in 2025, with China and Europe (notably Germany) leading the way.

Overall global equities fell 4.2% in Q1 (in GBP terms), the worst quarter since 2023, albeit most of this fall was driven by currency moves as weakness in the US dollar and relative strength in Sterling weakened overseas equity returns.

US equities started the year highly valued but with earnings no longer outperforming and significant economic uncertainty caused by Trump’s tariff talk, investors have looked for different homes for their money. US equities fell over 7% led by the Magnificent 7, with Tesla, in particular, performing very poorly.

Deepseek reminded investors that China has an impressive technology sector and with President Xi seeking a rapprochement with business leaders, Chinese equities have thrived up 11.6% led by the major technology stocks, such as Alibaba and Tencent.

Europe looked well placed to benefit from any ceasefire in Ukraine and with attractive valuations (compared to the US) and improving earnings, market performance improved. However, it was Germany’s historic release of its constitutional debt-brake in order to significantly increase investment in defence and infrastructure which has provided much needed stimulus into the European economy and has improved market sentiment. Europe ex-UK rose nearly 8% with Germany itself up 12%.

The end of US exceptionalism in stark contrast to 2024

Source: Artorius, Bloomberg

Indices used are: Global – MSCI All-Country World, Global ex US – MSCI World ex US, UK – FTSE All-Share, US – S&P 500, Europe ex UK – MSCI Europe ex UK, Japan – MSCI Japan, Emerging Markets – MSCI Emerging Markets, China – MSCI China

In Fixed Income, USD bonds have performed strongly as bond markets have priced in increased recessionary risks driving bond yields lower. While inflationary expectations have picked up at shorter maturities, investors seem less focused on the inflation side of tariffs and more on the growth repercussions of trade tensions. Lower credit quality bonds have been underperforming sovereigns, as credit spreads have risen from very low levels reflecting the risks to growth. European bonds have performed less well as despite further interest rate cuts from the European Central Bank, the scale of stimulus promised by Germany has seen investors demand a higher premium to invest and so driven up bond yields.

Bond yields have fallen across most regions leading to positive returns, particularly for global bonds

Source: Artorius, Bloomberg

Indices used are: GBP Cash – Barclays Benchmark Overnight GBP Cash Index, UK Gilts – Bloomberg UK Government All Bonds, GBP Corporates – IBOXX Sterling Non-Gilts, Global Bonds – Bloomberg Global Aggregate Hedged GBP, Global High Yield – Bloomberg Global High Yield Hedged GBP, Emerging Markets Debt – Bloomberg EM Hard Currency Aggregate Hedged GBP

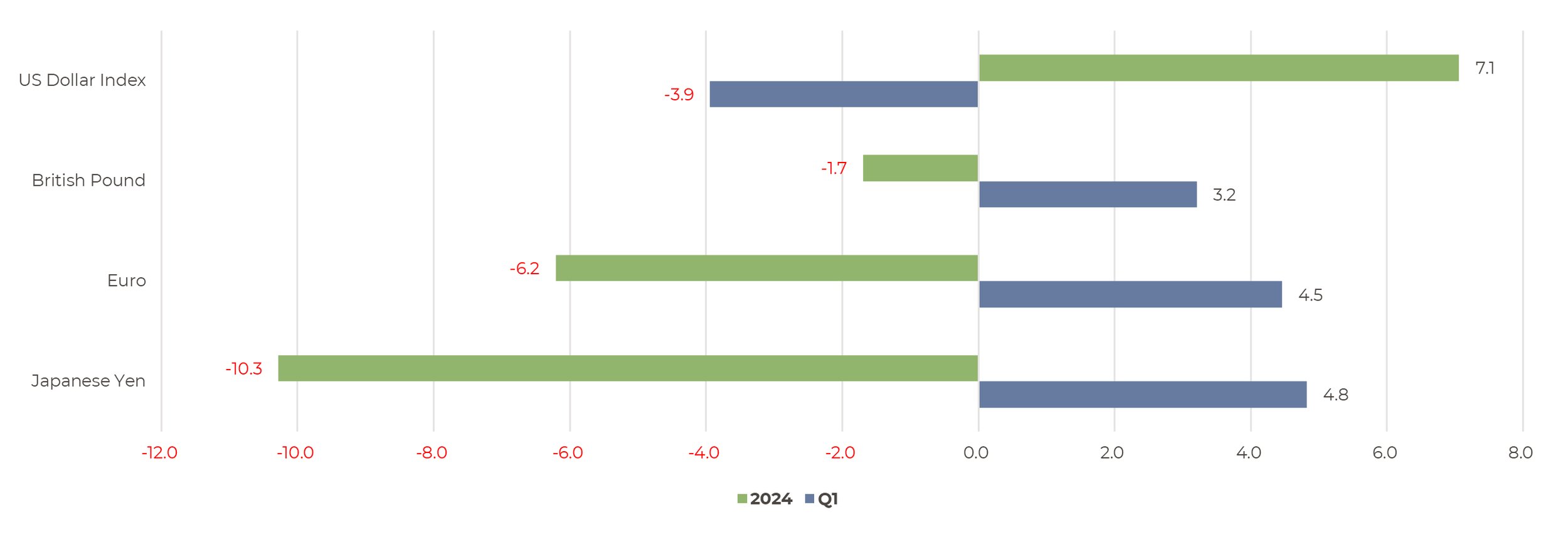

Dollar weakness has been the surprising fall-out from Trump 2.0 with currency moves almost a complete reversal from last year

Source: Artorius, Bloomberg

Changes in bond yields were a major driver of currency moves with softening US bond yields leading to weakness in the US dollar reversing the trend of last year. The Euro has been particularly strong following the policy change in Germany, while Japan is an outlier as interest rates are rising and this is supporting a stronger currency.

Overall, it was a negative quarter for most portfolios with bond market prices unable to fully offset equity weakness, particularly in higher risk strategies. With ongoing tariff concerns, we would expect market volatility to remain elevated through the coming months.

Gareth Thomas

Head of Investment Management

*Any feedback provided can be anonymous

Important Information

All expressions of opinion reflect the judgment of Artorius at 4th April 2025 and are subject to change, without notice. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete; we do not accept any liability for any errors or omissions, nor for any actions taken based on its content. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested. Past performance is not a reliable indicator of future results. Nothing in this document is intended to be, or should be construed as, regulated advice. Artorius provides this document in good faith and for information purposes only. Reliance should not be placed on the information contained within this document when taking individual investments or strategic decisions.

Artorius Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. Artorius is a trading name of Artorius Wealth Management Limited.

FP20250404001